10 Essential Auto Loan Tips

1. Shop Around for Rates

Compare loan offers from banks, credit unions, and dealers to secure the lowest interest rate. Don't settle for the first offer you receive.

2. Check Your Credit Score

Review your credit score before applying, as a higher score can get you better loan terms. Consider improving your score if needed.

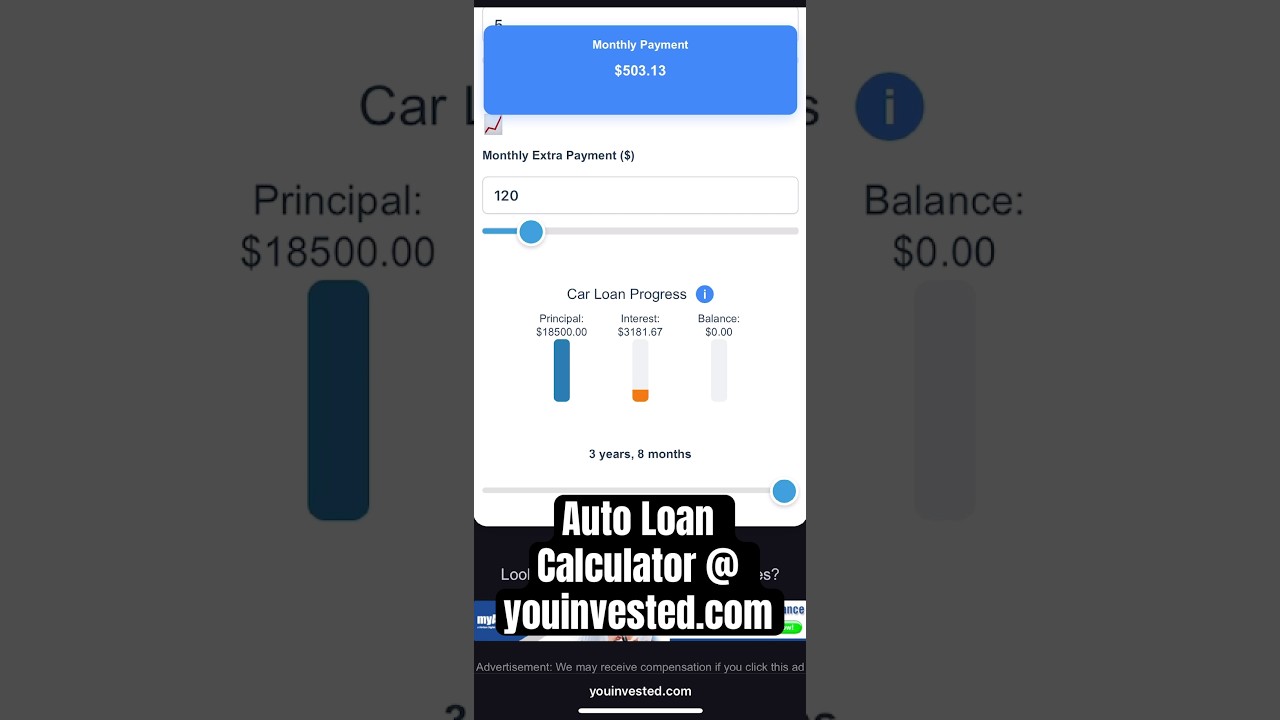

3. Consider Loan Terms Carefully

While longer terms (72-84 months) offer lower monthly payments, you'll pay significantly more interest. Use our calculator to compare total costs. Compare current rates to ensure you're getting the best deal.

4. Keep the Loan Term Short

Opt for the shortest loan term you can afford to reduce total interest paid. Longer terms mean more interest over time.

5. Make a Large Down Payment

Put down at least 20% to lower the loan amount and monthly payments. This also helps avoid being upside-down on your loan.

6. Avoid Upselling

Decline unnecessary add-ons like extended warranties or gap insurance if you don't need them. These can significantly increase your loan amount.

7. Understand Total Costs

Factor in interest, fees, taxes, and insurance when budgeting for the car. The sticker price is just the beginning of your expenses.

8. Pay More Than Minimum

Make extra payments toward the principal to pay off the loan faster and save on interest. This can significantly reduce your total cost.

9. Consider Refinancing

If rates drop or your credit improves, consider refinancing to get a lower rate. This can save you money on interest.

10. Read the Fine Print

Review all loan terms, including prepayment penalties or hidden fees, before signing. Make sure you understand everything you're agreeing to.