10 Essential Student Loan Tips

1. Understand Loan Types

Know the difference: Federal loans (Subsidized, Unsubsidized, PLUS) often offer more protections and repayment options than private loans.

2. Borrow Only What You Need

Education is an investment, but over-borrowing can lead to long-term financial strain. Create a budget and minimize loan amounts. Consider how compound interest calculator can work for you instead of against you when planning your financial future.

3. Maximize Free Aid First

Apply for scholarships, grants (like Pell Grants via FAFSA), and work-study programs before taking out loans.

4. Know Your Interest Rates

Fixed rates remain the same; variable rates can change. Understand how interest accrues (especially during grace periods or deferment) and capitalizes.

5. Explore All Repayment Options

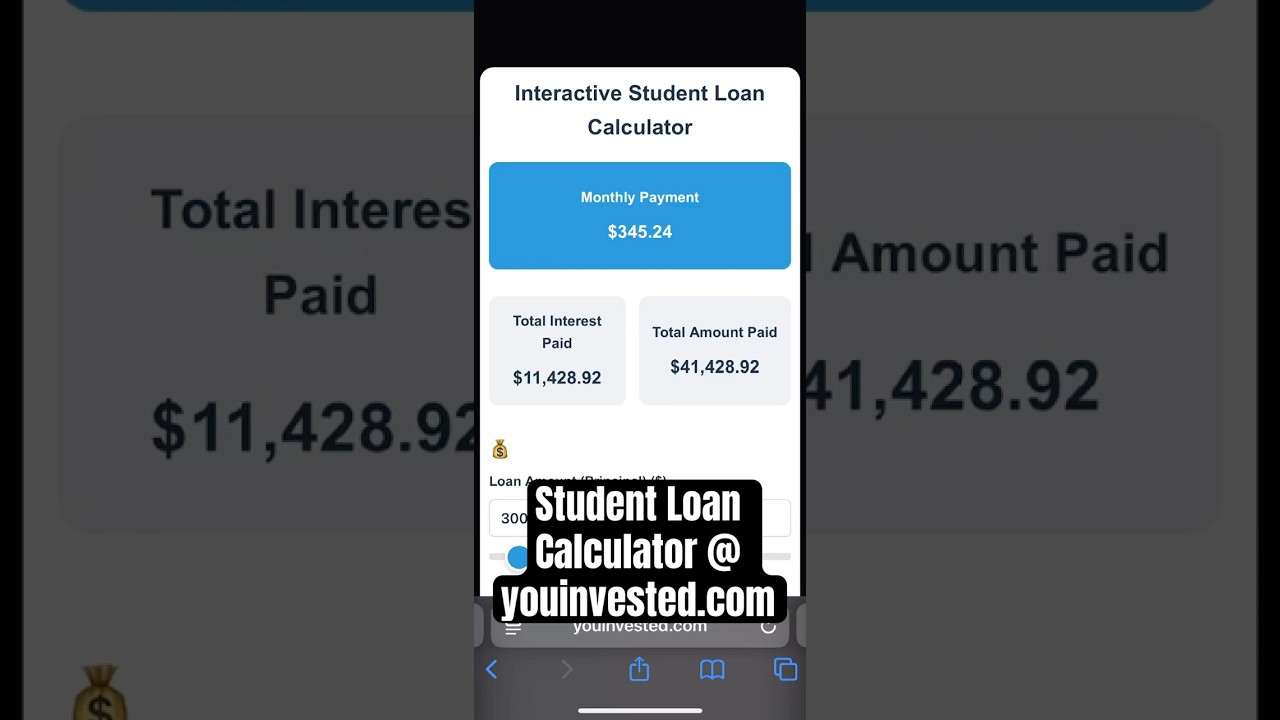

Federal loans offer various plans (Standard, Graduated, Income-Driven). Our calculator lets you compare standard monthly, biweekly payments, and income-driven repayment (IDR) options side-by-side to find the best fit for your financial situation.

6. Understand Grace Periods

Most federal loans have a 6-month grace period after graduation before payments begin. Interest may still accrue on unsubsidized loans during this time.

7. Stay in Touch with Servicers

Know who your loan servicer is, keep your contact information updated, and reach out if you're having trouble making payments.

8. Consider Autopay

Many lenders offer a small interest rate reduction (e.g., 0.25%) for enrolling in automatic payments. It also helps avoid missed payments.

9. Pay Extra When Possible

Making additional payments towards principal can dramatically reduce total interest. For example, on a $30,000 loan at 6% over 10 years, paying an extra $50/month saves $2,847 in interest and cuts 1.5 years off repayment. You can also switch to biweekly payments to make the equivalent of 13 monthly payments per year automatically. Also try our debt repayment calculator to see how different payment strategies affect all your loans.

10. Refinancing & Consolidation

Refinancing (often with a private lender) might get you a lower interest rate. Federal loan consolidation combines loans but doesn't always lower rates. Weigh pros and cons carefully.