How to Use Our Dynamic Compound Interest Calculator

See your investments compound in real-time! It's interactive and easy to use:

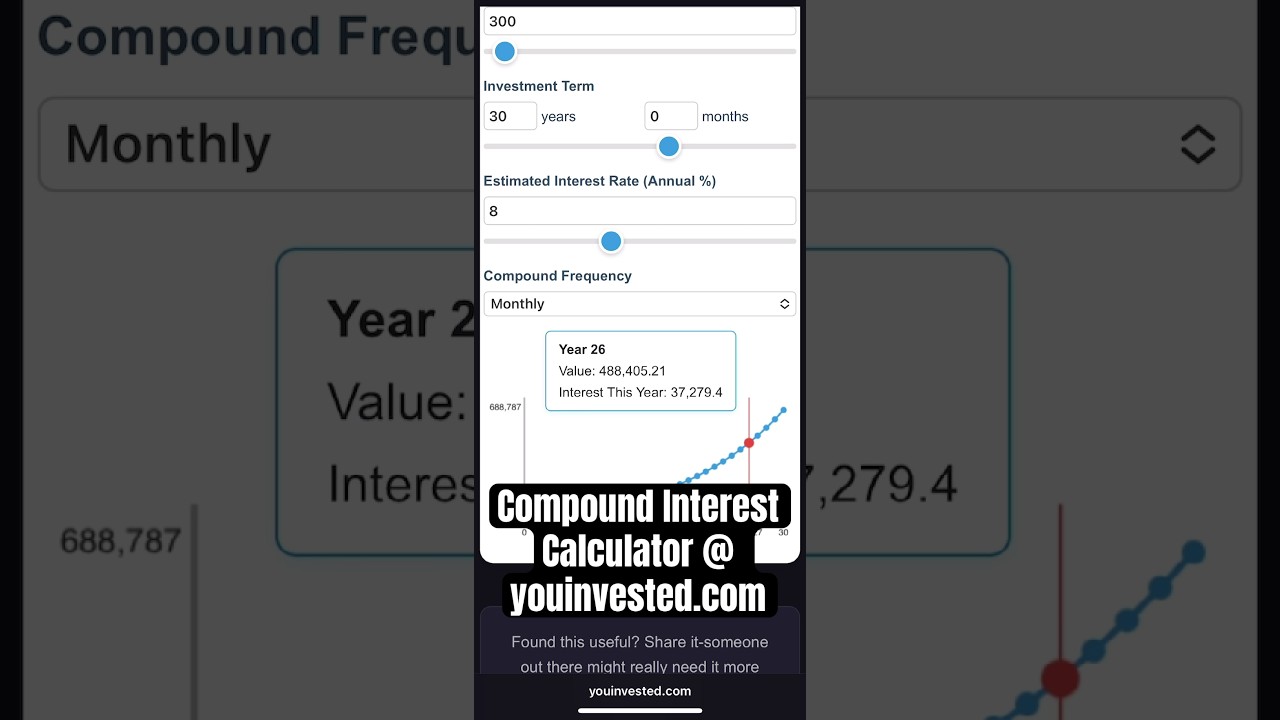

- Initial Investment: Your starting principal. Watch it grow as you add other inputs!

- Regular Contributions: How much you'll add periodically (e.g., monthly). See the dramatic effect of consistent saving, instantly.

- Interest Rate (%): Your expected annual rate of return. Observe how different rates impact your final sum instantly.

- Compounding Frequency: How often interest is calculated (e.g., annually, monthly). More frequent compounding can boost growth – see it happen in real-time.

- Time Horizon (Years): The longer you invest, the more compounding works its magic. Adjust and see the long-term potential in real-time.

This interactive compound interest calculator makes financial planning an engaging and insightful experience.

Why Use This Calculator

Visualize how compound interest grows over time with different contribution amounts, interest rates, and compounding frequencies. See the power of time and consistency in real-time.

Understanding Live Compounding Effects

Compound interest means earning "interest on your interest." Our dynamic calculator helps you see this powerful effect instantly. For investments in the stock market, see how compound growth can work even more powerfully with our Stock Investment Calculator →

- Principal Growth: Watch your base investment increase.

- Accumulated Interest: See how the interest earned starts earning its own interest, accelerating your wealth in real-time on screen.

Stop wondering and start visualizing! This interactive calculator makes understanding compound interest straightforward and motivating.